How To Write Off Charitable Donations . Find forms and check if the group you contributed to. As a general rule, you can deduct donations totaling up to. When you sit down to file your. for any donation over $250, you should get a written acknowledgment of the donation from the charity, including. you must itemize your deductions if you want to write off charitable donations. taxpayers can deduct charitable contributions by itemizing their deductions using schedule a (form 1040). in that case, you'd claim charitable donations on schedule a (form 1040). it discusses the types of organizations to which you can make deductible charitable contributions and the types of contributions you can deduct. charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. your charitable contributions may be deductible if you itemize.

from www.template.net

it discusses the types of organizations to which you can make deductible charitable contributions and the types of contributions you can deduct. you must itemize your deductions if you want to write off charitable donations. taxpayers can deduct charitable contributions by itemizing their deductions using schedule a (form 1040). Find forms and check if the group you contributed to. When you sit down to file your. As a general rule, you can deduct donations totaling up to. charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. your charitable contributions may be deductible if you itemize. in that case, you'd claim charitable donations on schedule a (form 1040). for any donation over $250, you should get a written acknowledgment of the donation from the charity, including.

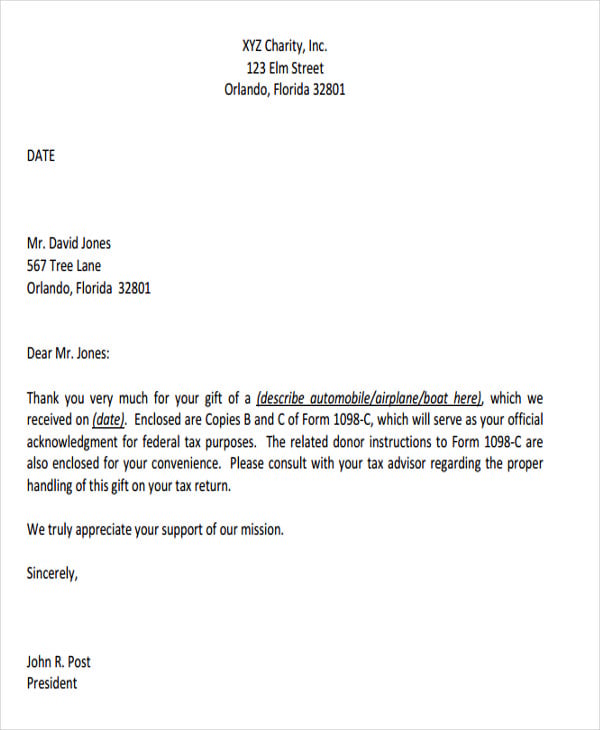

8+ Donation Acknowledgement Letter Templates Free Word, PDF Format Download

How To Write Off Charitable Donations charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. for any donation over $250, you should get a written acknowledgment of the donation from the charity, including. your charitable contributions may be deductible if you itemize. Find forms and check if the group you contributed to. it discusses the types of organizations to which you can make deductible charitable contributions and the types of contributions you can deduct. charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. As a general rule, you can deduct donations totaling up to. you must itemize your deductions if you want to write off charitable donations. in that case, you'd claim charitable donations on schedule a (form 1040). taxpayers can deduct charitable contributions by itemizing their deductions using schedule a (form 1040). When you sit down to file your.

From www.docformats.com

Write the Perfect Donation Request Letter (with Sample Letters) How To Write Off Charitable Donations When you sit down to file your. for any donation over $250, you should get a written acknowledgment of the donation from the charity, including. your charitable contributions may be deductible if you itemize. in that case, you'd claim charitable donations on schedule a (form 1040). taxpayers can deduct charitable contributions by itemizing their deductions using. How To Write Off Charitable Donations.

From templatelab.com

43 FREE Donation Request Letters & Forms ᐅ TemplateLab How To Write Off Charitable Donations As a general rule, you can deduct donations totaling up to. Find forms and check if the group you contributed to. When you sit down to file your. for any donation over $250, you should get a written acknowledgment of the donation from the charity, including. your charitable contributions may be deductible if you itemize. it discusses. How To Write Off Charitable Donations.

From www.youtube.com

How to Write Perfect DONATION LETTER for Charity to Make Them Donate WritingPractices YouTube How To Write Off Charitable Donations your charitable contributions may be deductible if you itemize. Find forms and check if the group you contributed to. you must itemize your deductions if you want to write off charitable donations. for any donation over $250, you should get a written acknowledgment of the donation from the charity, including. taxpayers can deduct charitable contributions by. How To Write Off Charitable Donations.

From bestlettertemplate.com

How to Write a Letter Asking for Donations or Sponsorship How To Write Off Charitable Donations in that case, you'd claim charitable donations on schedule a (form 1040). taxpayers can deduct charitable contributions by itemizing their deductions using schedule a (form 1040). your charitable contributions may be deductible if you itemize. Find forms and check if the group you contributed to. it discusses the types of organizations to which you can make. How To Write Off Charitable Donations.

From www.freesampletemplates.com

5 Charitable Donation Receipt Templates formats, Examples in Word Excel How To Write Off Charitable Donations you must itemize your deductions if you want to write off charitable donations. As a general rule, you can deduct donations totaling up to. for any donation over $250, you should get a written acknowledgment of the donation from the charity, including. When you sit down to file your. it discusses the types of organizations to which. How To Write Off Charitable Donations.

From www.template.net

30+ Donation Letter Templates PDF, DOC How To Write Off Charitable Donations charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. it discusses the types of organizations to which you can make deductible charitable contributions and the types of contributions you can deduct. When you sit down to file your. your charitable contributions may be deductible if you itemize. you must. How To Write Off Charitable Donations.

From templatelab.com

43 FREE Donation Request Letters & Forms ᐅ TemplateLab How To Write Off Charitable Donations As a general rule, you can deduct donations totaling up to. you must itemize your deductions if you want to write off charitable donations. When you sit down to file your. charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. it discusses the types of organizations to which you can. How To Write Off Charitable Donations.

From www.freesampletemplates.com

5 Charitable Donation Receipt Templates Free Sample Templates How To Write Off Charitable Donations Find forms and check if the group you contributed to. it discusses the types of organizations to which you can make deductible charitable contributions and the types of contributions you can deduct. for any donation over $250, you should get a written acknowledgment of the donation from the charity, including. charitable contributions or donations can help taxpayers. How To Write Off Charitable Donations.

From www.etsy.com

Thank You Letter for Donation Editable PDF Canva Templates Etsy How To Write Off Charitable Donations in that case, you'd claim charitable donations on schedule a (form 1040). for any donation over $250, you should get a written acknowledgment of the donation from the charity, including. charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. you must itemize your deductions if you want to write. How To Write Off Charitable Donations.

From aashe.net

Charitable Donation Receipt Template FREE DOWNLOAD Aashe How To Write Off Charitable Donations you must itemize your deductions if you want to write off charitable donations. As a general rule, you can deduct donations totaling up to. for any donation over $250, you should get a written acknowledgment of the donation from the charity, including. your charitable contributions may be deductible if you itemize. taxpayers can deduct charitable contributions. How To Write Off Charitable Donations.

From www.template.net

8+ Donation Acknowledgement Letter Templates Free Word, PDF Format Download How To Write Off Charitable Donations charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. you must itemize your deductions if you want to write off charitable donations. When you sit down to file your. Find forms and check if the group you contributed to. in that case, you'd claim charitable donations on schedule a (form. How To Write Off Charitable Donations.

From www.sampleforms.com

FREE 36+ Donation Forms in PDF MS Word Excel How To Write Off Charitable Donations As a general rule, you can deduct donations totaling up to. your charitable contributions may be deductible if you itemize. taxpayers can deduct charitable contributions by itemizing their deductions using schedule a (form 1040). charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. Find forms and check if the group. How To Write Off Charitable Donations.

From www.sampleforms.com

FREE 12+ Donation Letter Samples, PDF, MS Word, Google Docs How To Write Off Charitable Donations When you sit down to file your. it discusses the types of organizations to which you can make deductible charitable contributions and the types of contributions you can deduct. taxpayers can deduct charitable contributions by itemizing their deductions using schedule a (form 1040). Find forms and check if the group you contributed to. you must itemize your. How To Write Off Charitable Donations.

From www.pinterest.com

Explore Our Free Charitable Donation Receipt Template Donation letter template, Receipt How To Write Off Charitable Donations you must itemize your deductions if you want to write off charitable donations. it discusses the types of organizations to which you can make deductible charitable contributions and the types of contributions you can deduct. taxpayers can deduct charitable contributions by itemizing their deductions using schedule a (form 1040). When you sit down to file your. . How To Write Off Charitable Donations.

From www.sampletemplates.com

FREE 8+ Sample Donation Receipts in PDF How To Write Off Charitable Donations charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. your charitable contributions may be deductible if you itemize. in that case, you'd claim charitable donations on schedule a (form 1040). it discusses the types of organizations to which you can make deductible charitable contributions and the types of contributions. How To Write Off Charitable Donations.

From templatelab.com

43 FREE Donation Request Letters & Forms ᐅ TemplateLab How To Write Off Charitable Donations you must itemize your deductions if you want to write off charitable donations. in that case, you'd claim charitable donations on schedule a (form 1040). it discusses the types of organizations to which you can make deductible charitable contributions and the types of contributions you can deduct. charitable contributions or donations can help taxpayers to lower. How To Write Off Charitable Donations.

From www.sampletemplates.com

FREE 14+ Sample Donation Letter Templates in MS Word PDF Pages Google Docs MS Outlook How To Write Off Charitable Donations for any donation over $250, you should get a written acknowledgment of the donation from the charity, including. you must itemize your deductions if you want to write off charitable donations. in that case, you'd claim charitable donations on schedule a (form 1040). your charitable contributions may be deductible if you itemize. As a general rule,. How To Write Off Charitable Donations.

From www.sampletemplates.com

FREE 51+ Sample Donation Letter Templates in MS Word Pages Google Docs MS Outlook PDF How To Write Off Charitable Donations As a general rule, you can deduct donations totaling up to. it discusses the types of organizations to which you can make deductible charitable contributions and the types of contributions you can deduct. your charitable contributions may be deductible if you itemize. Find forms and check if the group you contributed to. in that case, you'd claim. How To Write Off Charitable Donations.